Before I became an entrepreneur, I spent more than 15 years working in corporate America where I helped build and manage one of the largest technology platforms in the world for Boeing Corporation. One would think that this experience would have prepared me well for life in a technology start-up, and in many ways it did. But in 2008 when I sat mulling over a growing list of options for how to successfully grow and exit this new business, life at Boeing seemed a lifetime away and my problems all seemed unique and quite perplexing. Fortunately for me, I had a good mentor, a been-there-done-that entrepreneur, who would take my late night phone calls and talk me through the ever-growing list of issues my team and I had to resolve. I am not sure we would have had our successful exit or that I would have been there to experience it without the steady guidance from others who had survived similar challenges before me.

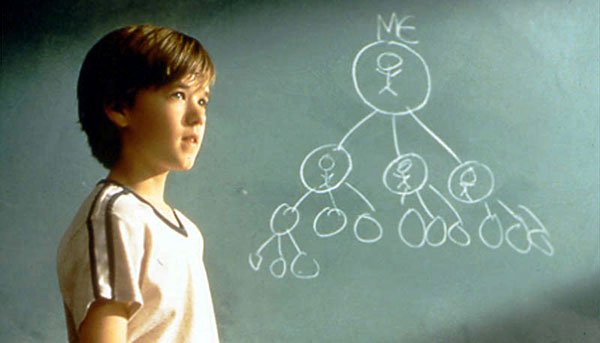

Contrary to popular belief, the success of Silicon Valley is not completely beholden to its access to capital. It is in large part, a product of the “pay-it-forward” effect. Put a different way, let me pose a question: What kills a startup? Lack of technical expertise? No, because you can buy this off the rack in most cases. Insufficient funding? Not always, there are companies that grow organically. Lack of experience? Yes, always!

The Pay it Forward effect and the importance of experience are completely related. The lion’s share of the best lessons bequeathed to entrepreneurs come from some other been-there-done-that entrepreneur. They pay-it-forward with experience to help the next crop.

Anyone who has built a successful startup knows fully well that they have, at some point, received help. I am not echoing the (perhaps misconstrued?) sentiments expressed in “You didn’t build that” but I am referring to the real help from some other successful entrepreneur, someone who actually knew what they were doing when you, frankly, did not. You received an insight on strategy, a lead for a source of funding at a critical moment, a contact to close a key sale, a tip on a new head of technology, or perhaps just a bit of confidence from someone who has made it to the other side. There is a very real PIF ethic among entrepreneurs. In Silicon Valley, the Pay it Forward culture is 11 on a 10 point scale. It is a club of sorts, similar to climbing Everest: each entrepreneur needs to climb Everest themselves, but they will be glad to know how much oxygen to bring. Without a doubt money is critical, but money without mentorship leads to a DOA venture. Mentors bring invaluable insights, experience, cadence, and a sense of patience that is essential to nurture a cool idea on the back of a napkin through to a business that spins out profits.

While iSelect is known for its efforts to unlock capital in regional markets, we also focus on galvanizing and energizing the Pay it Forward effect in St. Louis and beyond. iSelect sources funding from accredited investors, often current or former self-made entrepreneurs. Apart from investing, these peddlers of influence also advocate for our portfolio companies, telling others about the ventures’ new products and technology and helping them find customers. Additionally, iSelect’s diligence team includes executives that have built and sold successful ventures in industries including agriculture, energy, technology, and aerospace. These proven executives offer keen market insight and often join ventures as an executive or board member. Once iSelect invests in a company, it also markets it in industry verticals. As we become hyper-connected to key networks within industry verticals, we lay more foundation for St. Louis’ PIF culture. Each of us plays a role in our pay it forward culture. If you believe, as we do, that entrepreneurs make America great, pay it forward!